By Courtney Cox | gargoyle@flagler.edu

Flagler College students sit at their desks, bleeding anxiety as they selectively listen for their cue: a due date. It will be another big essay, project or test to cram for, and that’s exactly what they’ll be doing–cramming.

Students are juggling their way through college, trying to get a handle on their education and all the responsibilities that come with it. And the biggest one of all? The cost. It’s forced college students to get a job while they’re in school and, in some cases, more than one.

“You can’t work your way through college anymore,” according to Georgetown University’s “Learning While Earning: The New Normal. “A generation ago, students commonly saved for tuition by working summer jobs. But the cost of college now makes that impossible. A student working full-time at the federal minimum wage would earn $15,080 annually before taxes. That isn’t enough to pay tuition at most colleges, much less room and board and other expenses.”

However, one Flagler College student has been paving her own way with a serving job at Harry’s Seafood Bar and Grill so that she can support herself and her education.

“I pay for everything except my health insurance,” said Madison Hess, a senior and elementary education major.

Hess has her work cut out for her with a full-time elementary education internship in a second-grade classroom Monday through Friday. Then, add her five-day-a-week job serving at Harry’s. And last but not least, sprinkle in her independent research assistantship for her environmental science minor and she’s left with roughly two or three hours for school work each day, she said.

These days, she said, she isn’t as involved on campus.

“Everything kind of conflicts once you get down to the work, the homework, the sleep—there’s not time for it,” Hess said.

Around 29 percent of college students, ages 16 to 29, work 40 plus hours a week, according to the 2015 Georgetown University’s “Learning While Earning: The New Normal.”

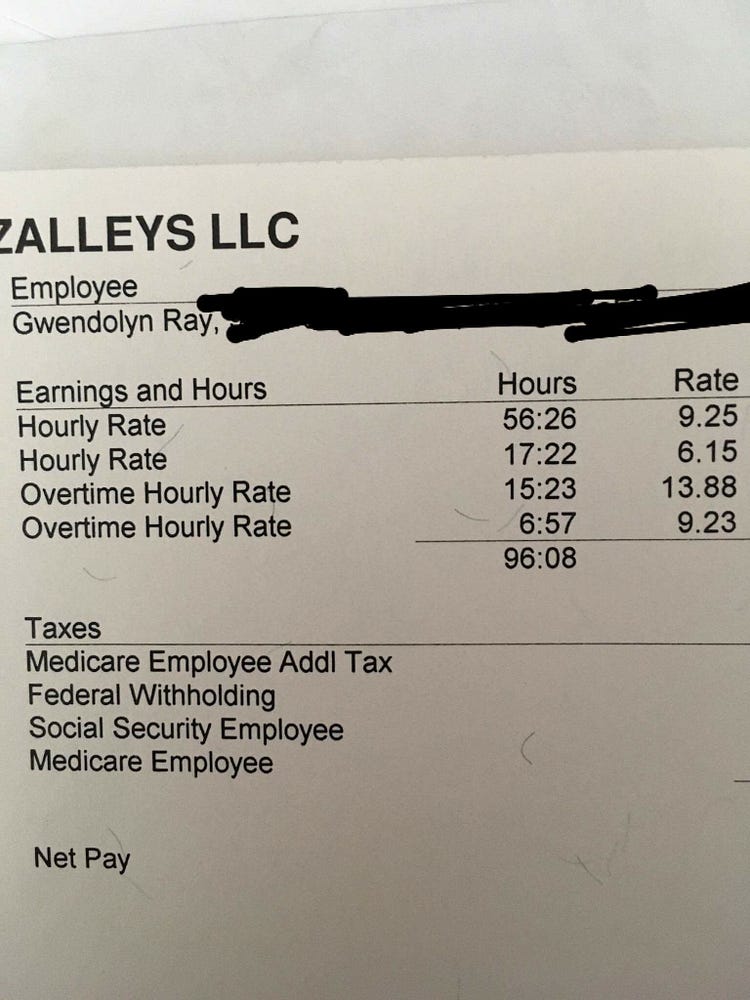

For Gwendolyn Ray, a junior at Flagler College, she’s no stranger to long work weeks. She serves and hosts at Pizzalley’s Chianti Room in downtown St. Augustine. During the summer, Ray worked 50 hours a week and intends to work 50 to 60 hours a week during her winter break, she said.

Ray, a theatre arts major, struggled her sophomore year. She couldn’t balance work and school when she found herself working 35 hours a week on top of taking 16 credits and having a show to prepare for that semester as well, she said.

“My focus became work before school,” Ray said.

She’s learned since then and is now working a necessary 20 hours a week while taking 18 credits.

“It’s much more manageable,” Ray said.

However, manageable still comes with a price.

“I have about $100 in my bank account right now,” Ray said. “Living paycheck to paycheck is not fun. I think being a broke college student gets romanticized by the media.”

This became a harsh reality for Ray when she went to the doctor and realized she couldn’t afford her medical bill, she said. So, she had to turn to her mom in hopes of some financial assistance.

Although Ray admitted her strict budget hardly allows her to buy a $5 Starbucks coffee, she said that she feels lucky to have the life she has.

“I still have a roof over my head, I have food in my pantry and I know I can afford food with my next paycheck,” Ray said.

Pierce Ernst, a sophomore and double major in business and coastal environmental science at Flagler College, appreciates the struggle that comes with the strife.

“You could have the hardest schedule in the world, but you know, that’s part of college, that’s part of life: managing time, relationships, friends and work and everything. Everyone needs to learn that during college,” Ernst said. “Some people aren’t lucky enough to be at college so you can’t really be complaining because it’s a good opportunity.”

Ernst works 12-hour shifts at the White Room on weekends and owns an apparel company, Beach Town Bums. His financial responsibilities are like that of Hess; he pays for essentially everything in his life.

With money on his mind, Ernst feels like he’s missed out on college experiences, he said.

“You gotta do what you gotta do,” Ernst said.

For Ray though, doing what she’s “gotta do” has taken its toll on her social life.

“I would see myself closing myself off from my friends and not giving myself that time to be a person and do person things,” Ray said. “Sadly, because I’m so heavy in my workload and everything I don’t really get a chance to have relationships because I’m paying for this.”

It becomes a lot of stress to handle at once and every couple of weeks Ray finds herself in a place where breaking down is the only option, she said.

“Typically it’s I’m ordering a pizza,” Ray said. “I’m going to eat the whole pizza in one sitting and probably find some alcohol.”

As for Hess, she’s had her share of tantrums where crying feels like the best option, she said. However, Hess has found her own means of unwinding from life at work and school.

“I figured out that exercise really does help. Any time I start running again I feel better and the stress kind of goes away,” Hess said. “All the little stuff doesn’t matter anymore.”

Right now life is a “Yin and Yang” and there’s a lot of give and take, but Hess said she’s taking it as it is.

Hess, as well as Ray and Ernst are all tirelessly working their ways to the top.

“I’m still moving forward. I’m not allowing any of it to hold me back,” Ray said. “But right now I understand I work in a restaurant and I’m a broke college student.”

Ernst keeps a positive attitude through it all even though he admits it isn’t easy working in college.

“It’s hard work,” Ernst said. “It’s the hardest work I’ve done.”

At the end of the day, he said he knows it will pay off.

“It’s obviously worth it.”

Be the first to comment on "College: the time of your life or hardest time of your life"